Under or Overperforming

-

Jesse is a Native Montanan and the co-founder and CEO of Geniuslink - or, as he likes to say, head cheerleader. Before Jesse co-founded Geniuslink, he was a whitewater rafting guide, worked at a sushi restaurant, a skate/snowboard shop, was a professional student, and then became the first Global Manager at Apple for the iTunes Affiliate Program.

- November 14, 2023

You probably track your affiliate commissions like a hawk. You likely know exactly what affiliate programs you are using and what they are paying.

And while you might have an idea of how your earnings change over time, do you know how your earnings per click and conversion rates stack up against others? If you’re anything like many creators we work with, the answer is probably not.

We see lots of blogs talking about specific affiliate programs, we’ve even written a number of them ourselves, but these blogs all too often are about what you could earn, not how much creators and publishers are actually earning.

We also see many creators humbly share how much in affiliate revenue they are generating, but this is often “all up,” and minimal context included, so it often looks like a flex instead of a learning opportunity.

In our relentless pursuit to be good citizens of our industry, we wanted to shed some light on how some of the various affiliate programs that we use actually perform. We are doing this NOT so you can stack them up against each other (though that will inevitably happen) and NOT to encourage you to pick one program over the other.

Rather our goal is to provide transparency in our results in hopes it can provide clear guidance on if you are under or overperforming. If we can help you also identify additional programs to include with your future efforts then that is icing on the cake.

In our unique position, we were able to pull data from Kit, our platform that helps creators most effectively monetize their links by sharing the products they love.

We grabbed commission data for Q1 of this year — January through March 2022 — which includes over 400K* clicks representing about $40K* in commissions from more than 40 affiliate programs (17 Amazon Associates programs and +20 other name brand affiliate programs).

Commission data came from various dashboards (e.g., Associates Central, Impact, Partnerize, Sovrn Commerce, etc.), while clicks data came from our in-house tracking (except for programs run through Sovrn Commerce where we used their click data). The benefit of using click data through Geniuslink for all applicable programs is that it normalizes nuances in how each platform counts clicks.

*Quick note that collectively, Kit helps creators make millions of dollars in commissions; we are only looking at our portion of the earnings — see more about how Kit earns commissions.

Before diving into the data…

- Please note that the best programs for your niche or audience might not be the ones we found paid out the highest or converted the best. These numbers are for our community of creators on Kit, which skew toward content creators, influencers, and YouTubers.

- Context always matters, and you know your audience best! If your niche and audience are similar to our creators, you should be able to use this as a guide as you experiment with the best programs to maximize your earnings.

- Take it all with a grain of salt!

Ultimately, the best affiliate programs for monetizing your audience are simply the ones that correspond with the stores your audience will buy from. A huge commission rate on no sales means… zilch and back to ramen for dinner every night.

We can do better than that!

We’ve also found that adopting a multi-retailer approach is much more effective than putting “all your eggs in the single basket,” e.g., focusing on a single affiliate program. Instead of swapping out one affiliate program for another, just use both! We tested tens of thousands of links with over a dozen clients while developing our Choice Pages feature and found that using a multi-retailer approach more than doubled conversion rates and total commissions! Here in 2022, it’s just industry best practice.

Enough table-setting.

What does the data say?!

Comparing Conversion Rates

Amazon is our undisputed conversion rate king, and it’s not even close.

Recall that conversion rate is sales (or an “action” as reported by some dashboards) divided by clicks.

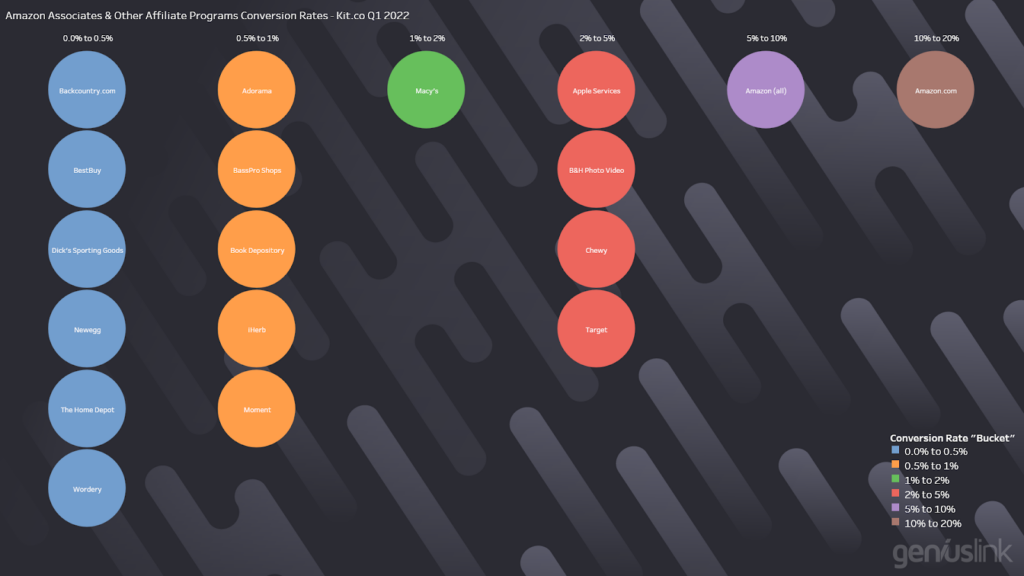

Across all the affiliate programs we looked at, the average conversion rate was 2.3%.

Amazon.com (11.1%) converts 3x higher than the next highest program (Apple Services) and nearly 5x better than the average.

That’s huge!

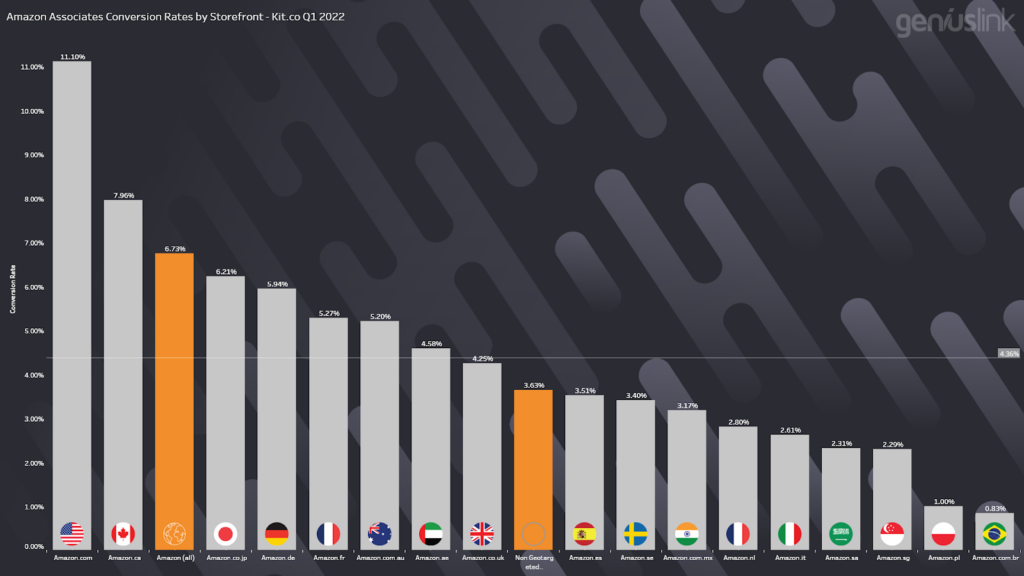

And if we look at the average conversion rate of all of Amazon’s 17 digital storefronts* — we’ll call this “Amazon (all)” — across the world, it also performs well! Amazon (all) converted at 6.7%, nearly twice as high as Apple Services and nearly three times as high as the average conversion rate.

* Note that Amazon has 21 independent and regional storefronts and operates 19 public affiliate programs; Kit is not a member of all the programs.

This illustrates an excellent point: good geo-targeting is essential for high conversion rates (Geniuslink, the technology behind empowering the affiliate links on Kit, is the market leader in geo-targeting, and Amazon and Apple Services were the first two programs we focused our expertise on). If link localization, aka geo-targeting, didn’t exist, then Amazon (all) conversion rates would be about 3.6% (roughly half of what they are with geo-targeting). This point is at the core of why we, Geniuslink, exist, and we’ve written extensively about the importance of geo-targeting links.

Why the ranges? We discuss in depth below but the ranges were our compromise to give you as transparent of data as possible for benchmarking while still protecting what some affiliate programs might consider confidential information. While we don’t necessarily agree with them it’s important that we all have a good working relationship and if you want to see data like this on a regular basis it’s important we don’t get Kit kicked out of the relevant affiliate programs.

Affiliate Program Conversion Rates

Here is how the rest of the conversion rates of the affiliate programs we are tracking look:

Program | Conversion Rate |

Amazon.com | 10% to 20% |

Amazon (all) | 5% to 10% |

Apple Services | 2% to 5% |

B&H Photo Video | 2% to 5% |

Target | 2% to 5% |

Macy’s | 1% to 2% |

Adorama | 0.5% to 1% |

BassPro Shops | 0.5% to 1% |

Book Depository | 0.5% to 1% |

iHerb | 0.5% to 1% |

Moment | 0.5% to 1% |

Backcountry.com | 0.0% to 0.5% |

BestBuy | 0.0% to 0.5% |

Dick’s | 0.0% to 0.5% |

Newegg | 0.0% to 0.5% |

Wordery | 0.0% to 0.5% |

Note that in looking at conversion rates we are strictly looking at affiliate programs where a conversion represents a sale, not a click. As a result, we had to pull out a number of the programs that we leveraged through Sovrn Commerce due to the common practice among sub-affiliate networks to layer in Cost Per Click campaigns and thus exploding the Conversion Rate.

For example, the claimed conversion rate, via Sovrn Commerce, for Wayfair was 98%, Sweetwater at 95%, and Walmart at 92%! While we love what the inclusion of CPC does for the total earnings and is reflected in our EPC deep dive below, we didn’t think it was fair to include these in our conversion rate deep dive.

Conversion Rates Across Amazon

Here is how Kit’s conversion rates across the 17 Amazon Associates programs look:

And, broken down into a table:

Program | Conversion Rate |

Amazon.com | 11.1022% |

Amazon.ca | 7.9552% |

Amazon.co.jp | 6.2143% |

Amazon.de | 5.9402% |

Amazon.fr | 5.2724% |

Amazon.com.au | 5.2014% |

Amazon.ae | 4.5777% |

Amazon.co.uk | 4.2469% |

Amazon.es | 3.5145% |

Amazon.se | 3.3997% |

Amazon.com.mx | 3.1700% |

Amazon.nl | 2.7994% |

Amazon.it | 2.6136% |

Amazon.sa | 2.3114% |

Amazon.sg | 2.2923% |

Amazon.pl | 0.9990% |

Amazon.com.br | 0.8331% |

Why the radical difference between Amazon.com and Amazon.com.br?

Great question!

While we don’t have a definitive answer, we think it relates to a variety of factors, including…

- How mature the storefront is (the Brazil, Poland, Singapore, and Saudi Arabia storefronts were introduced relatively recently compared to US, Canada, Japan, and German ones).

- The size of the product catalog of each storefront.

- The market share and e-commerce competitors that exist in that region.

Earnings Per Click

Let’s move to the next key metric, the actual payout from different programs.

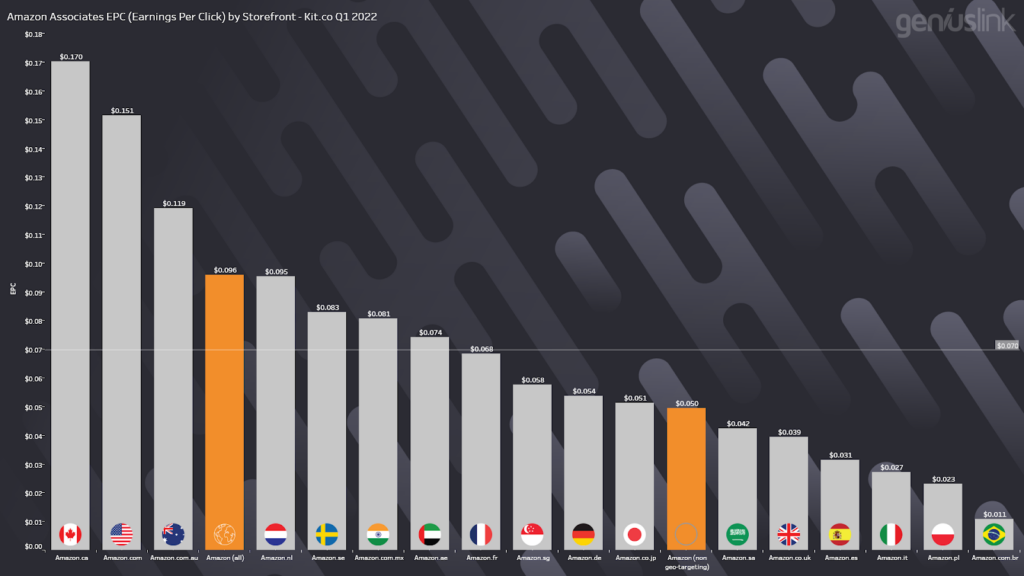

We like to track earnings, not as a whole, but with the Earnings Per Click (EPC) metric, as it normalizes total commissions earned across clicks and inherently reflects commission rates, conversion rates, average cart sizes, and other key factors.

The EPC metric allows you to rank your highest-paying programs to your lower-paying programs regardless of the click volume each sees. It’s also how a small YouTuber can benchmark itself against a more established one.

Wayfair

Wayfair sits at the top of the list at over a dollar EPC, nearly 3X the payout of the next best program! However, there are a couple of unique things about our measure of Wayfair that should be noted.

First, Wayfair has a relatively low click count during Q1, so their EPC could decrease (or increase) with a larger sample. Second, Kit monetizes Wayfair through Sovrn Commerce, so it appears we are earning not only from CPA (affiliate) but also CPC (cost per click), which leads to the incredibly high conversion rate (each click appears to be paid out on).

Traditionally CPC programs are a bit more fleeting while CPA programs are more secure, so this EPC may be very different in six to 12 months. Finally, Wayfair’s product catalog is chock full of higher-cost items, so it’s not too surprising that clicks and sales would also payout higher.

Moment

Coming in nearly 3X higher than the next affiliate program (Amazon.com), we attribute Moment’s second-place status as the only program between $0.25 and $0.50 EPC to how well they manage their affiliate program and the unique setup of their store. ShopMoment.com is unique in that they make and sell their products, have a smaller and more curated catalog than, say B&H and certainly Amazon, that consists of highly coveted gear, and finally, they also sell services (“experiences” related to their products as well). Moment is a fairly new affiliate program, and it will be interesting to see where they go. It is also important to note that Moment also had a relatively low relative click count in our Q1 sample set.

Amazon.com

Even though it’s in a group with five other programs we can say that Amazon.com rounds out the top three. We believe this starts with the Amazon brand having high loyalty (blame Prime’s dominance), significant trust, a massive product catalog, and the biggest market share in the US (Emarketer claims that Amazon accounts for 40% US Ecommerce market share). Further, their affiliate program is incredibly simple to use through decades of subtle refinement. Amazon’s affiliate program also allows for “Halo commissions” — affiliates can earn from sales on any product sold, not just the specific product being recommended. Amazon’s incredibly high conversion rates, as mentioned above, and large product catalog plus huge market share help drive this overall performance.

Note that good geo-targeting is essential for high EPC rates as well as conversion rates. If link localization / geo-targeting didn’t exist then our calculations for Amazon might include all the clicks, across all their programs, but only the Amazon.com commissions (as sales to consumers in other parts of the world would be at a significantly lower conversion rate which is one of the major reasons that Amazon spends billions creating new storefronts around the world). To keep the math simple, if we assume that the conversion rate for international customers is zero, then EPC would be $0.0495 (roughly half of what they are with geo-targeting!).

Program | EPC |

Wayfair* | $1.00 to $2.00 |

Moment | $0.25 to $0.50 |

$0.10 to $0.25 | |

B&H Photo Video | $0.10 to $0.25 |

BassPro Shops | $0.10 to $0.25 |

Gamestop* | $0.10 to $0.25 |

Kohl’s* | $0.10 to $0.25 |

Sweetwater* | $0.10 to $0.25 |

Adorama | $0.05 to $0.10 |

Amazon (all) | $0.05 to $0.10 |

Book Depository | $0.05 to $0.10 |

eBay* | $0.05 to $0.10 |

Macy’s | $0.05 to $0.10 |

Target | $0.05 to $0.10 |

Walmart* | $0.05 to $0.10 |

AliExpress* | $0.01 to $0.05 |

Apple Services | $0.01 to $0.05 |

Banggood* | $0.01 to $0.05 |

BestBuy | $0.01 to $0.05 |

iHerb | $0.01 to $0.05 |

Lowes* | $0.01 to $0.05 |

Others* | $0.01 to $0.05 |

Backcountry.com | $0.00 to $0.01 |

Bloomingdales* | $0.00 to $0.01 |

Dick’s | $0.00 to $0.01 |

Newegg | $0.00 to $0.01 |

Thomann* | $0.00 to $0.01 |

Wordery | $0.00 to $0.01 |

* The asterisks after a name designates that Kit monetized the store via Sovrn Commerce and affiliate commissions may be augmented with a pay out per click instead of solely per sale.

Amazon (all)

Collectively, calculated as an average across all 17 of the Amazon Associates programs that we measured, we saw that Amazon ranked 9th for total payout per click at $0.0959. Digging in a bit deeper here, we see that Amazon (all) amongst its Amazon peers sits fourth.

In case you are scheming to maximize earnings, It’s important to note here that it would be inadvisable to take all the clicks from countries that map to the Amazon affiliate programs that fall below a certain threshold and send them to Amazon.ca, Amazon.com, or Amazon.com.au.

This, unfortunately, will reduce your conversion and EPC rates as a whole. It’s the geo-targeting of clicks and sending shoppers to a local Amazon storefront that is optimized for them with the local language, currency, and fast and affordable shipping, that allows for the awesome conversion rate and relatively high EPCs that Amazon’s Associate program can offer.

Program | EPC |

Amazon.ca | $0.1703 |

Amazon.com | $0.1514 |

Amazon.com.au | $0.1191 |

Amazon (all) | $0.0959 |

Amazon.nl | $0.0953 |

Amazon.se | $0.0828 |

Amazon.com.mx | $0.0807 |

Amazon.ae | $0.0742 |

Amazon.fr | $0.0685 |

Amazon.sg | $0.0576 |

Amazon.de | $0.0537 |

Amazon.co.jp | $0.0512 |

Amazon (non-geo targeted) | $0.0495 |

Amazon.sa | $0.0423 |

Amazon.co.uk | $0.0393 |

Amazon.es | $0.0314 |

Amazon.it | $0.0272 |

Amazon.pl | $0.0231 |

Amazon.com.br | $0.0109 |

How Are You Ranking?

Understanding your conversion rates and EPC is table stakes in the affiliate space. What we are sharing here is aimed at helping creators compare apples-to-apples across affiliate programs, to help them think strategically about how they are performing, and finally, about which programs might be a good addition to their overall strategy.

If you find that you are focusing on using Amazon’s affiliate program solely and happen to be underperforming compared to our numbers, we’d recommend you give your audience the option to purchase from niche programs that complement your Amazon links.

Relatively niche affiliate programs like B&H Photo & Video, Wayfair, and Moment show either strong conversion rates or EPCs, and even if these aren’t the main affiliate programs, you can use this to your advantage with a multi-retailer approach to not only boost your conversion rates but the amount you take home each month. (See the “Choice Effect”!)

We’d love for you to leave us an (anonymous) comment below sharing which affiliate programs you use and where your EPC or Conversion rates sit for the first quarter of the year.

Side Note: Not for everyone

We found it really surprising that not all affiliate programs liked to be included in analyses like these.

Maybe we shouldn’t have been too surprised, but unfortunately, a few better-performing programs politely asked that we not include them in our analysis (and thus were removed to the detriment of this article).

We do believe that it’s important to note that most of the results we’ve shared are “derivative” works as they combine our proprietary click counts in calculating both the EPC and Conversion Rates (again, except for when we monetized a program through Sovrn Commerce).

Because of this, we believe we are not violating one of Amazon’s Operating Agreement Policies stating that anything from their Associates Central Dashboard is considered confidential and not to be shared publicly. As a result we were inclined to leave the specific numbers for Amazon’s EPC and Conversion Rates.

Author

-

Jesse is a Native Montanan and the co-founder and CEO of Geniuslink - or, as he likes to say, head cheerleader. Before Jesse co-founded Geniuslink, he was a whitewater rafting guide, worked at a sushi restaurant, a skate/snowboard shop, was a professional student, and then became the first Global Manager at Apple for the iTunes Affiliate Program.

Author

-

Jesse is a Native Montanan and the co-founder and CEO of Geniuslink - or, as he likes to say, head cheerleader. Before Jesse co-founded Geniuslink, he was a whitewater rafting guide, worked at a sushi restaurant, a skate/snowboard shop, was a professional student, and then became the first Global Manager at Apple for the iTunes Affiliate Program.

More revenue from every link you share

Geniuslink makes localizing, tracking, and managing smart links dead simple, so you can earn more without added work.